Fees and penalties—known as tasas y multas in Spanish—play a crucial role in both daily life and financial management. Whether you're navigating government procedures, handling banking transactions, or dealing with legal obligations, understanding the distinction between tasas (fees) and multas (penalties) is essential for maintaining compliance and avoiding unnecessary expenses.

Key Features of Tasas y Multas:

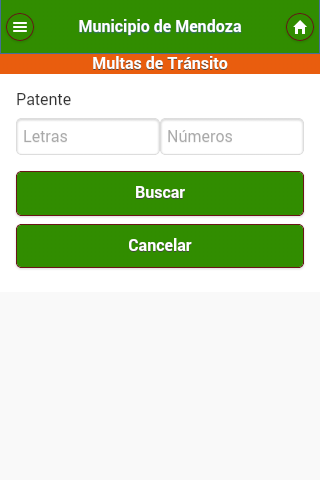

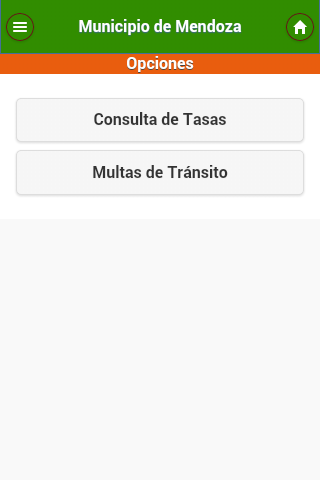

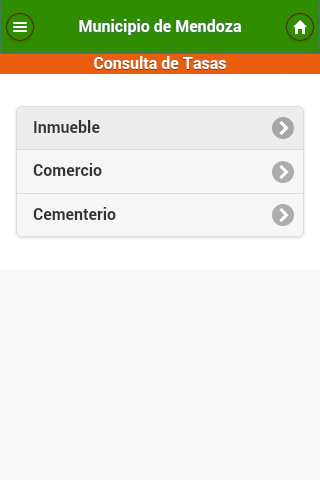

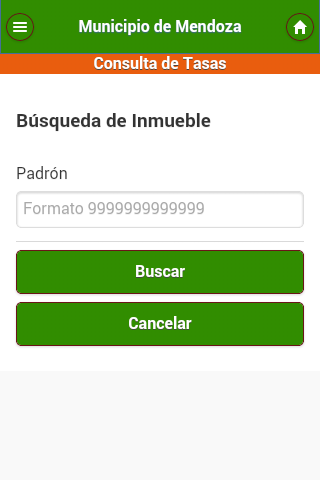

Convenient Payment Methods: The Tasas y Multas platform enables users to efficiently settle municipal fees related to property, cemetery services, advertising, and fines. After payment, users can opt to receive a digital receipt via email and even generate an electronic payment confirmation for future reference.

Secure Online Transactions: Users can conduct safe and easy online payments through established networks like Banelco and Link Payments. This eliminates the need to visit physical offices, allowing full transaction capabilities from anywhere at any time.

Mobile Integration: The app is fully compatible with mobile applications such as BanelcoMOVIL and Link Cell. Those who already have these apps installed can seamlessly link them to the Tasas y Multas system, streamlining the payment process.

Automated Calculations and Alerts: The system automatically computes charges and generates accruals for new installments. It also provides critical information regarding the start of enforcement actions and expiration dates of payment plans, helping users stay informed and avoid delays.

Frequently Asked Questions:

Is my personal and financial data secure when using the app?

Yes, all online transactions are protected with advanced security protocols. Your data remains confidential and safeguarded during the entire payment process.Can I pay fines issued by other municipalities through this app?

No, the platform is specifically designed for local municipal fees and fines. It may not support payments for fines issued by external jurisdictions.How quickly will I receive a payment receipt after completing a transaction?

In most cases, receipts are sent instantly to the email address on file. However, temporary delays may occur due to network or server issues.

▶ What Are Tasas?

Tasas, or fees, are charges applied for accessing specific services or completing administrative procedures. These fees are typically regulated and transparent, allowing individuals and businesses to anticipate and budget for them accordingly. Common examples include:

- Government service fees: Required for processing documents such as passports, driver's licenses, or permits.

- Banking fees: Applied for account maintenance, wire transfers, or ATM usage.

- Utility service fees: Related to water, electricity, sewage, or waste disposal services.

- Municipal taxes: Levied by local governments to fund infrastructure and public safety initiatives.

Since tasas are generally predictable and based on official guidelines, they are easier to manage within a personal or business financial plan.

▶ What Are Multas?

Multa, or penalties, are imposed as a consequence of violating laws, regulations, or contractual terms. Unlike tasas, which are standard service charges, multas serve as deterrents for non-compliance. Examples include:

- Traffic violations: Such as speeding tickets, illegal parking, or running a red light.

- Late tax payments: Penalties incurred for missing tax filing deadlines or underreporting income.

- Business infractions: Fines for violating labor laws, environmental policies, or health and safety standards.

The goal of multas is to encourage lawful behavior and ensure that individuals and organizations meet their legal and financial responsibilities.

▶ How to Effectively Manage Tasas y Multas

To avoid unnecessary costs and maintain good standing with authorities and institutions, consider the following best practices:

- Stay compliant: Follow traffic rules, submit required paperwork on time, and fulfill your tax obligations to avoid incurring multas.

- Track important deadlines: Awareness of due dates for payments and filings helps prevent late fees and penalties.

- Monitor your accounts regularly: Review bank statements, utility bills, and legal notices to detect and dispute any unexpected charges.

- Understand local laws: Regulations can vary significantly across regions, so being informed about local tasas y multas structures is key to proper planning and compliance.

By staying proactive and informed, you can effectively manage your financial responsibilities while minimizing the impact of fees and avoiding costly penalties.