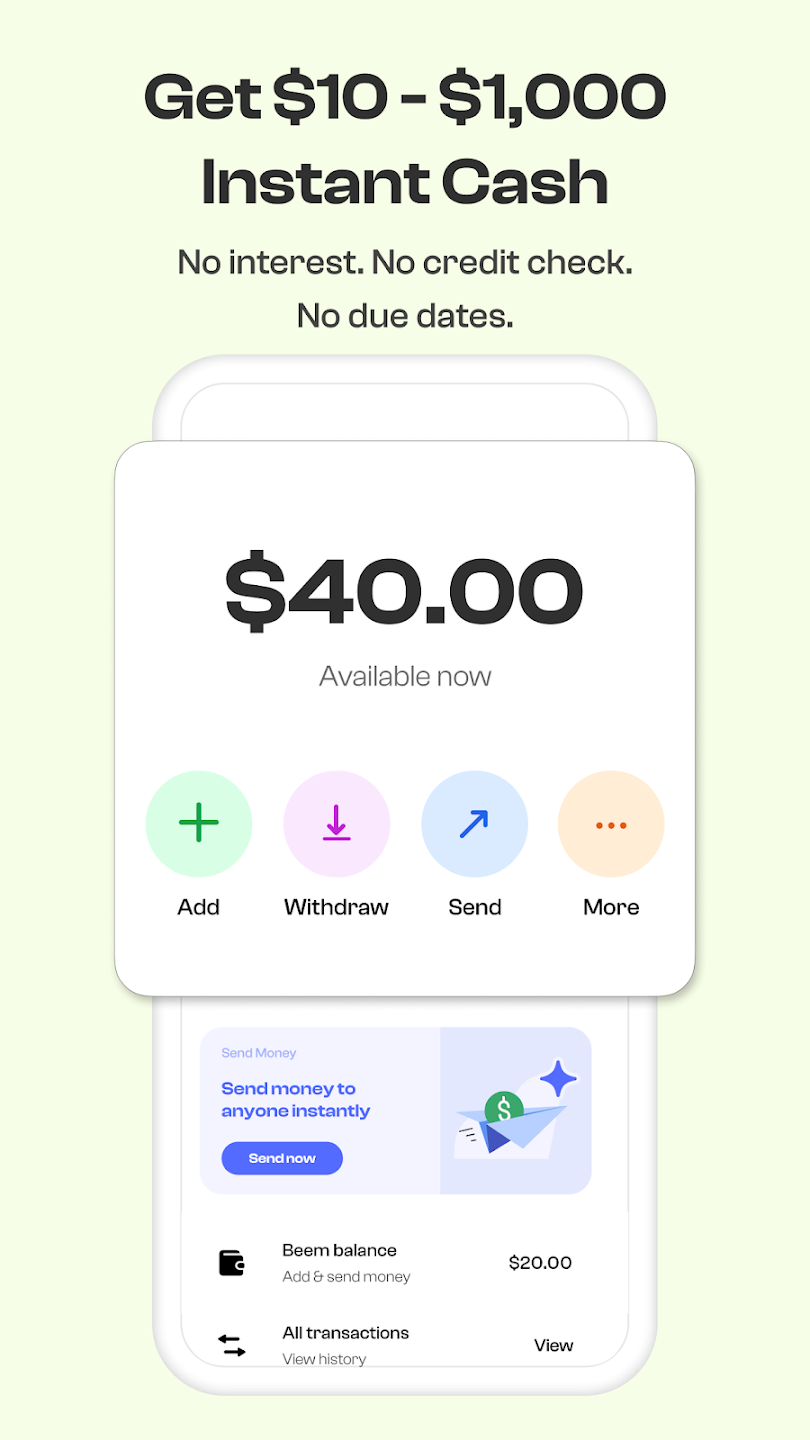

Beem is a dynamic financial app that revolutionizes the way you manage your money with its innovative Everdraft™ feature, offering instant cash advances. This app allows users to quickly access funds ranging from $10 to $1,000 without the hassle of credit checks or extensive paperwork. With Beem Boost, you can even unlock additional cash. Beyond cash advances, Beem serves as a comprehensive financial tool, providing free tax filing, car insurance quotes, cashback rewards, and identity theft protection, ensuring you have everything you need to manage your finances effectively.

Features of Beem: Instant Cash Advance App:

Instant Cash Advances: Beem enables users to borrow instant cash advances ranging from $10 to $1,000, accessible in just a few taps on the app.

No Interest Charges: Unlike traditional payday loans, Beem does not charge any interest on the cash advances, making it a more affordable option for those in need of quick cash.

No Credit Checks: With Beem, you can borrow money without a credit check, making it an inclusive solution for individuals regardless of their credit history.

FICO Score Protection: Utilizing Beem's cash advances does not impact your FICO score, ensuring your creditworthiness remains unaffected.

Tips for Users:

Set Up Notifications: To ensure you never miss an opportunity to access instant funds, enable notifications from the Beem app.

Repay on Time: To maintain a good standing with Beem and potentially access larger advances in the future, always repay your cash advances promptly.

Use Responsibly: While Beem offers easy access to instant cash, it's crucial to use this feature responsibly and only borrow what is necessary to cover unexpected expenses.

How to Use Beem:

Download the App: Install Beem from the App Store or Google Play.

Create an Account: Sign up and verify your identity.

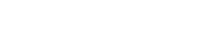

Link Your Bank: Connect your bank account for seamless transactions.

Apply for Cash Advance: Request an advance through the Everdraft™ feature.

Receive Your Cash: Once approved, the funds are quickly transferred to your account.

Use the Cash: Utilize the cash for any immediate financial need.

Repay the Advance: Follow the repayment terms outlined in the app.

Explore Additional Features: Make use of Beem's offerings like tax filing, budget planning, and insurance services.

Check Your Account: Regularly monitor your account for updates and transaction history.

Contact Support: For any questions or issues, reach out to Beem's customer support team.